Some Ideas on Reverse Mortgage You Should Know

Advertiser Disclosure At Nerd Wallet, we make every effort to assist you make monetary decisions with self-confidence. To do this, lots of or all of the products included here are from our partners. Nevertheless, this doesn't affect our assessments. Our opinions are our own. After retirement, without regular earnings, you may in some cases struggle with finances.

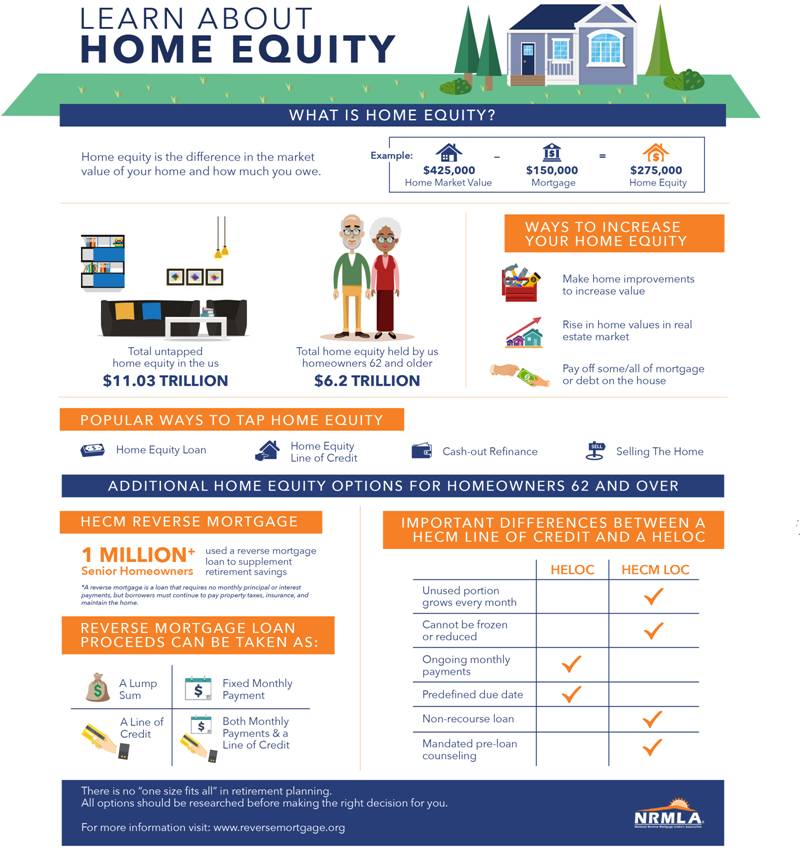

A reverse home mortgage is a house loan that enables property owners 62 and older to withdraw a few of their home equity and transform it into cash. You don't have to pay taxes on the profits or make regular monthly mortgage payments. You can use reverse home mortgage earnings however you like. They're often allocated for expenses such as: Debt debt consolidation Living expenditures Home enhancements Assisting kids with college Purchasing another home that might much better satisfy your requirements as you age A reverse home loan is the opposite of a standard home mortgage; rather of paying a lender a monthly payment each month, the loan provider pays you.

The amount you receive in a reverse home loan is based on a moving scale of life span. The older you are, the more home equity you can pull out." MORE: How to get a reverse mortgage The Federal Real estate Administration insures two reverse home loan types: adjustable-rate and a fixed-rate.

The Ultimate Guide To Home Morgages

2. Adjustables have 5 payment choices: Period: Set regular monthly payments so long as you or your eligible partner remain in the home Term: Set month-to-month payments for a set duration Credit line: Unspecified payments when you require them, till you have actually exhausted your funds Modified tenure: A credit line and set regular monthly payments for as long as you or your eligible http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/reverse mortages partner reside in the home Customized term: A credit line and set month-to-month payments for a set duration of your picking To make an application for a reverse home loan, you need to satisfy the following FHA requirements: You're 62 or older You and/or a qualified spouse-- who must be called as such on the loan even if she or he is Residential Mortages not a co-borrower-- live in the house as your primary house You have no overdue federal debts You own your home outright or have a substantial quantity of equity in it You attend the mandatory therapy session with a home equity conversion home loans (HECM) therapist approved by the Department of Real Estate and Urban Development Your home fulfills all FHA property requirements and flood requirements You continue paying all real estate tax, homeowners insurance and other family upkeep fees as long as you reside in the house Before providing a reverse mortgage, a lender will check your credit report, validate your regular monthly earnings versus your monthly financial commitments and buy an appraisal on your house.

Almost all reverse home loans are released as home equity conversion mortgages (HECMs), which are guaranteed by the Federal Housing Administration. HECMs include rigid borrowing standards and a loan limit. If you think a reverse home loan might be best for you, discover an FHA-approved loan provider.

Are you thinking about whether a reverse home loan is right for you or an older house owner you understand? Prior to thinking about among these loans, it pays to understand the realities about reverse home mortgages. A reverse mortgage, sometimes referred to as a House Equity Conversion Home Mortgage (HECM), is an unique type of loan for property owners aged 62 and older that lets you transform a part of the equity in your https://en.wikipedia.org/wiki/?search=reverse mortages house into money.

The Best Strategy To Use For Reverse Mortage Tips

Securing a reverse home loan is a big decision, since you might not have the ability to get out of this loan without offering your house to settle the debt. You also require to thoroughly consider your alternatives to prevent utilizing up all the equity you have constructed up in your house.

Reverse mortgages usually are not utilized for getaways or other "fun" things. The truth is that many borrowers use their loans for instant or pushing monetary requirements, such as settling their existing mortgage or other financial obligations. Or they may consider these loans to supplement their monthly income, so they can afford to continue living in their own home longer.

Getting any mortgage can be pricey since of origination fees, servicing costs, and third-party closing charges such as an appraisal, title search, and recording http://www.bbc.co.uk/search?q=reverse mortages expenses. You can pay for most of these expenses as part of the reverse mortgage. Reverse home mortgage customers likewise need to pay an upfront FHA home mortgage insurance premium.

9 Simple Techniques For Reverse Mortgage

It likewise ensures that, when the loan does become due and payable, you (or your heirs) do not need to repay more than the worth of the home, even if the quantity due is higher than the assessed value. While the closing costs on a reverse home loan can in some cases be more than the expenses of the house equity credit line (HELOC), you do not need to make monthly payments to the lender with a reverse home loan.

It's never ever a great concept to make a monetary decision under tension. Waiting up until a small problem ends up being a big problem reduces your alternatives. If you wait until you are in a monetary crisis, a little additional earnings each month probably will not assist. Reverse home mortgages are best utilized as part of a sound financial strategy, not as a crisis management tool.

Learn if you may certify for aid with expenses such as real estate tax, house energy, meals, and medications at Benefits Check Up®. Reverse home mortgages are best used as part of an overall retirement strategy, and not when there is a pending crisis. When HECMs were first provided by the Department of Housing and Urban Development (HUD), a big percentage of debtors were older females wanting to supplement their modest earnings.

Reverse Mortgage Can Be Fun For Anyone

During the housing boom, lots of older couples took out reverse home loans to have a fund for emergency situations and extra money to enjoy life. In today's financial recession, younger debtors (frequently Child Boomers) are turning to these loans to manage their current mortgage or to help pay for financial obligation. Reverse mortgages are special due to the fact that the age of the youngest debtor figures out just how much you can borrow.

Choosing whether to get a reverse mortgage loan is challenging. It's hard to estimate the length of time you'll remain in your house and what you'll need to live there over the long term. Federal law needs that all people who are thinking about a HECM reverse mortgage get therapy by a HUD-approved therapy company.

They will also talk about other options consisting of public and private benefits that can assist you remain independent longer. It's important to satisfy with a counselor before speaking with a lender, so you get unbiased info about the loan. Telephone-based therapy is available across the country, and in person counseling is readily available in many neighborhoods.

How Reverse Mortgage can Save You Time, Stress, and Money.

You can likewise discover a counselor in your location at the HUD HECM Therapist Lineup. It is possible for reverse home mortgage customers to deal with foreclosure if they do not pay their home taxes or insurance coverage, or keep their home in great repair. This is particularly a danger for older property owners who take the whole loan as a swelling sum and spend it rapidly-- possibly as a desperate effort to salvage a bad situation.